Reimagining

Wealth

Generation

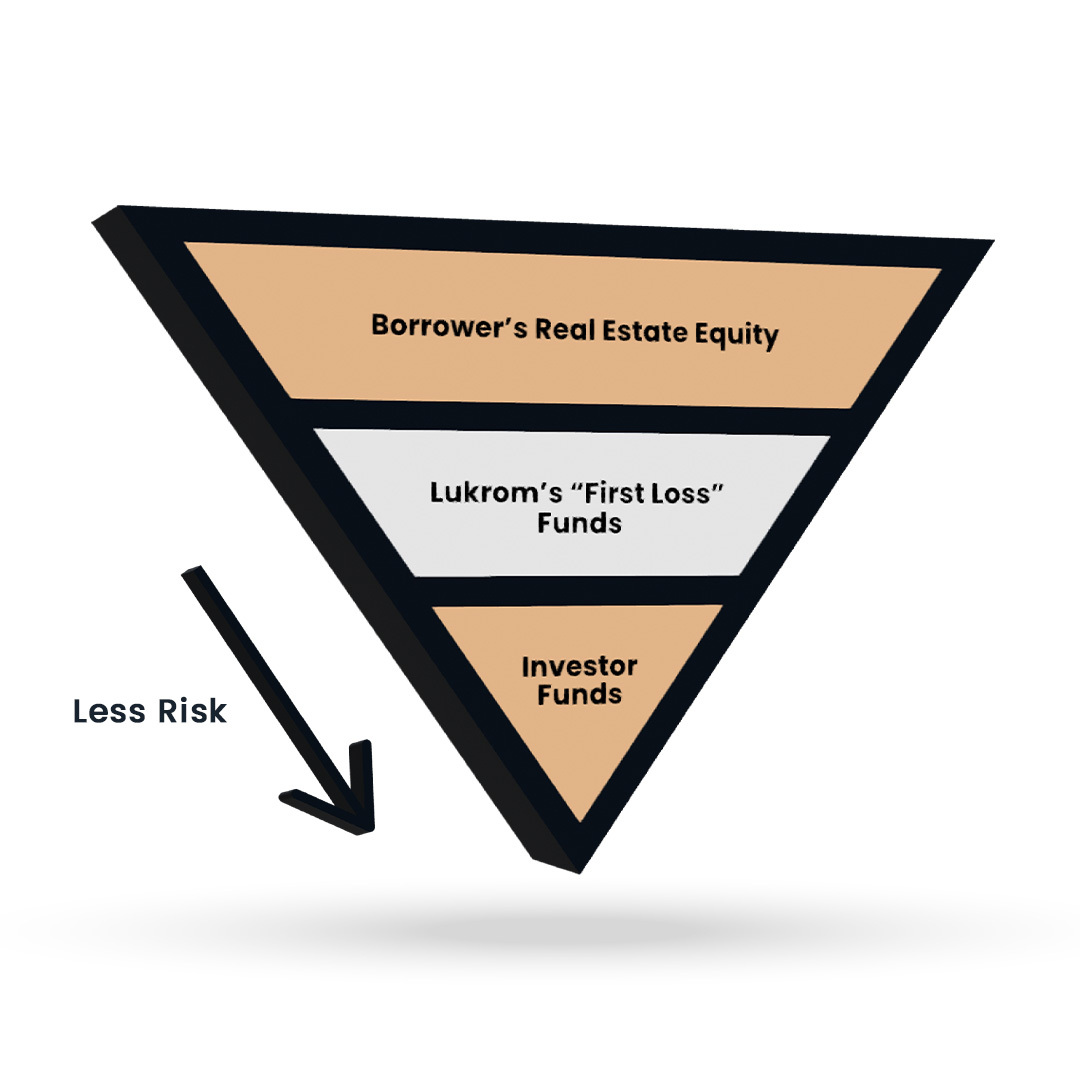

The Lukrom iFund has a $15M First Loss Protection, meaning the Fund would have to lose $15M before investor funds are impacted.

NO OTHER FUND IS DOING THIS!

We Put Our Investors First

$15M FIRST LOSS COMMITMENT

When we say we put our investors first, we mean it. $15M of Lukrom iFund is invested by our Executive Team and Advisory Board in a “First Loss” position. Although we don’t anticipate any losses, this First Loss Commitment will absorb any potential losses that extend beyond the real estate equity of the borrowers. NO OTHER FUND IS DOING THIS!

SIGNIFICANT PROTECTION AGAINST LOSS

Safety of Principal

- Primarily 1st position deeds of trust.

- Low-leverage.

- Comfortable debt levels (on average less than 70% loan to value).

- Principals and Employees of Lukrom have their money in a First Loss position, keeping your money safer.

REIT Tax Advantages

- Our REIT structure allows for a Qualified Business Income Deduction (QBID) available to our investors to reduce your taxes by 20% from Lukrom iFund LP. This can reduce your federal tax rate from 37% to 29.6%, a substantial tax savings.

- Can use qualified funds or non-qualified.

- Eliminates Unrecognized Business Taxable Income (UBTI) for tax sheltered investments (IRA, Pension Plans, 401k).

Transparency

- We will show you everything and anything you ask to see.

- Lukrom iFund LP is a fully administered fund by Armanino, one of the most respected accounting firms in private lending.

- Lukrom iFund LP performs annual audited financials by CohnReznick, another highly respected and prestigious accounting firm in private lending.

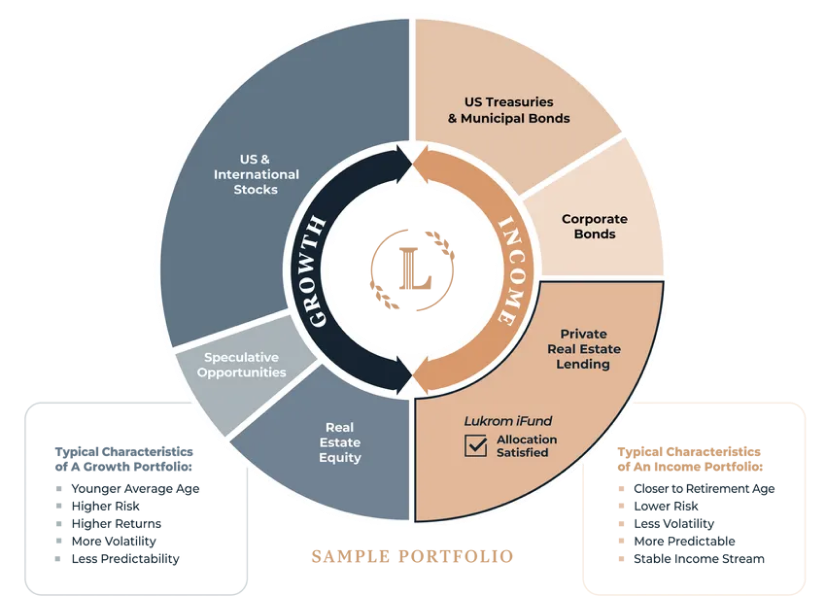

Excellent Returns with Low Volatility

- Net returns on par or exceeding historical returns from the stock market without the stress-inducing volatility.

- Money invested with Lukrom far outpaces the loss of spending power caused by inflation.

Predictability

- Short-term loans (typical 12-months) allow us to adjust our lending guidelines as the economy changes

- We typically work with borrowers we have established relationships with, maximizing the reliability of planned outcomes

Reliable Income or Wealth Generation

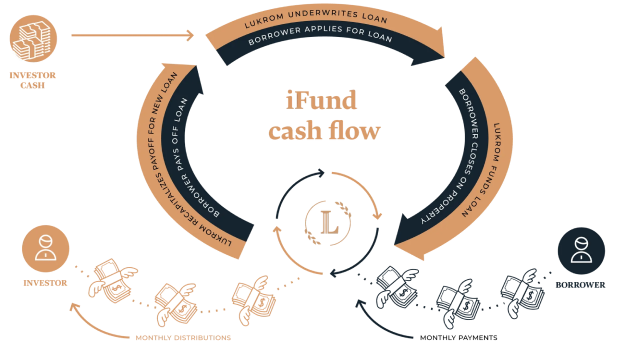

- We invest in performing loans that generating regular monthly income that we distribute to our investor on a monthly basis

- You can elect to compound your investment for even higher ROIs and wealth generation

SCHEDULE A DISCOVERY CALL

Lukrom iFund LP

Our Leadership

Thomas McPherson

CEO & Advisory Board Member

As a real estate entrepreneur and veteran of the US Navy, Thomas enjoys solving problems and engaging with teams. He began his real estate career as an apartment broker and quickly moved into founding a private capital group to work with underperforming real estate. He continued growing the company and founded others, allowing him to transact in a broad range of property types.

A real estate entrepreneur and U.S. Navy veteran, Thomas enjoys engaging in visionary work with diverse teams to solve challenging problems. While serving in the Navy, Thomas earned his Surface Warfare and Fleet Marine Force Warfare designations and completed extensive combat medical training as an FMF Corpsman. He learned how to heal the human body, and now through leadership, he seeks to heal our communities and the planet. Thomas began his real estate career as a broker with Sperry Van Ness, winning their National Rookie of the Year Award in 2010. He then moved to Hendricks & Partners (now Berkadia), the premier multifamily brokerage firm in the US.

In 2012, Thomas founded Fenix Private Capital Group LLC to focus on improving underperforming real estate assets throughout